The Power of Long-Term Investment: Why Patience Pays

Stephen O'Driscoll

At MyWealthManagement, we firmly believe that achieving the best returns from your investments hinges on a crucial principle: it’s not about timing the market but about the time you spend in the market. Patience truly pays off! Investors who stay committed through various market cycles ultimately fare better than those attempting to predict the perfect moments to buy and sell, often missing out on significant gains.

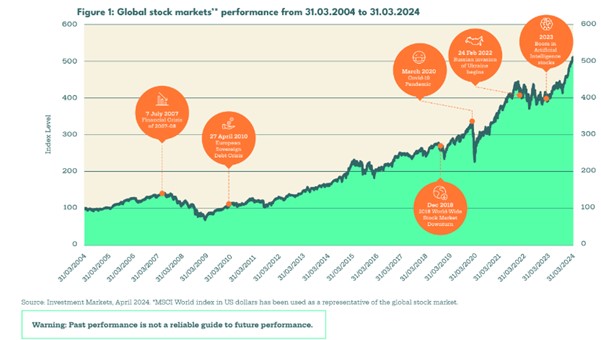

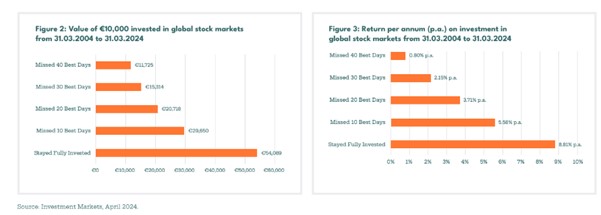

Take, for example, the performance of a global stock market index like the MSCI World Index over the past 20 years. It clearly illustrates that avoiding the worst days often means missing out on some of the best returns. While it’s challenging to grasp during periods of market volatility, where investments may temporarily lose value, the long-term perspective is key.

At MyWealthManagement, we emphasise the importance of only investing when you have a solid emergency fund and sufficient day-to-day funds. This ensures you can weather short-term market fluctuations without needing to withdraw your investments prematurely. The worst time to cash out is during a market downturn. A robust emergency fund allows you to leave your investments untouched, giving them the necessary time to recover and achieve capital growth. Historically, some of the best years for investments have followed some of the worst.

By maintaining a long-term perspective and ensuring financial stability in the short term, you position yourself to reap the rewards of sustained market growth. The graphic below from New Ireland demonstrates the undeniable power of staying invested for the long haul, reinforcing the value of patience in the world of investments.

Global Stock Markets Performance from 31/03/2004 to 31/03/2024

About MyWealthManagement

Established in 2008, MyWealthManagement Limited together with its sister company MyMortgages.ie have built a reputation for delivering bespoke wealth management and financial planning advice in Ireland.

Working from Dublin and Cork, we service clients throughout Ireland providing financial reviews and determining based on the individual and family needs, the best solutions for Life Insurance, Serious Illness Cover, Income Protection, Mortgage Protection, Pensions, Investment and Savings. Whether you are starting out, or making a step-change in your career or preparing for retirement, taking some time to consider your financial future and security is important. We can help you with the first step of reviewing your current plans and discuss any requirements you may have on portfolio management, insurance protection, asset allocation & security selection, previous employment buyout bonds, PRSA & personal pensions, Executive schemes & SSAPs, post retirement ARFs & AMRFs, succession & inheritance planning as well as an independent audit & review service.

Like to chat with Stephen about Investment and Savings options to suit your needs. Drop a line to: [email protected]